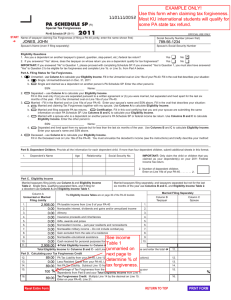

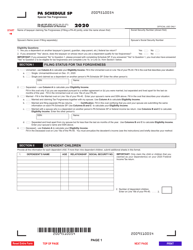

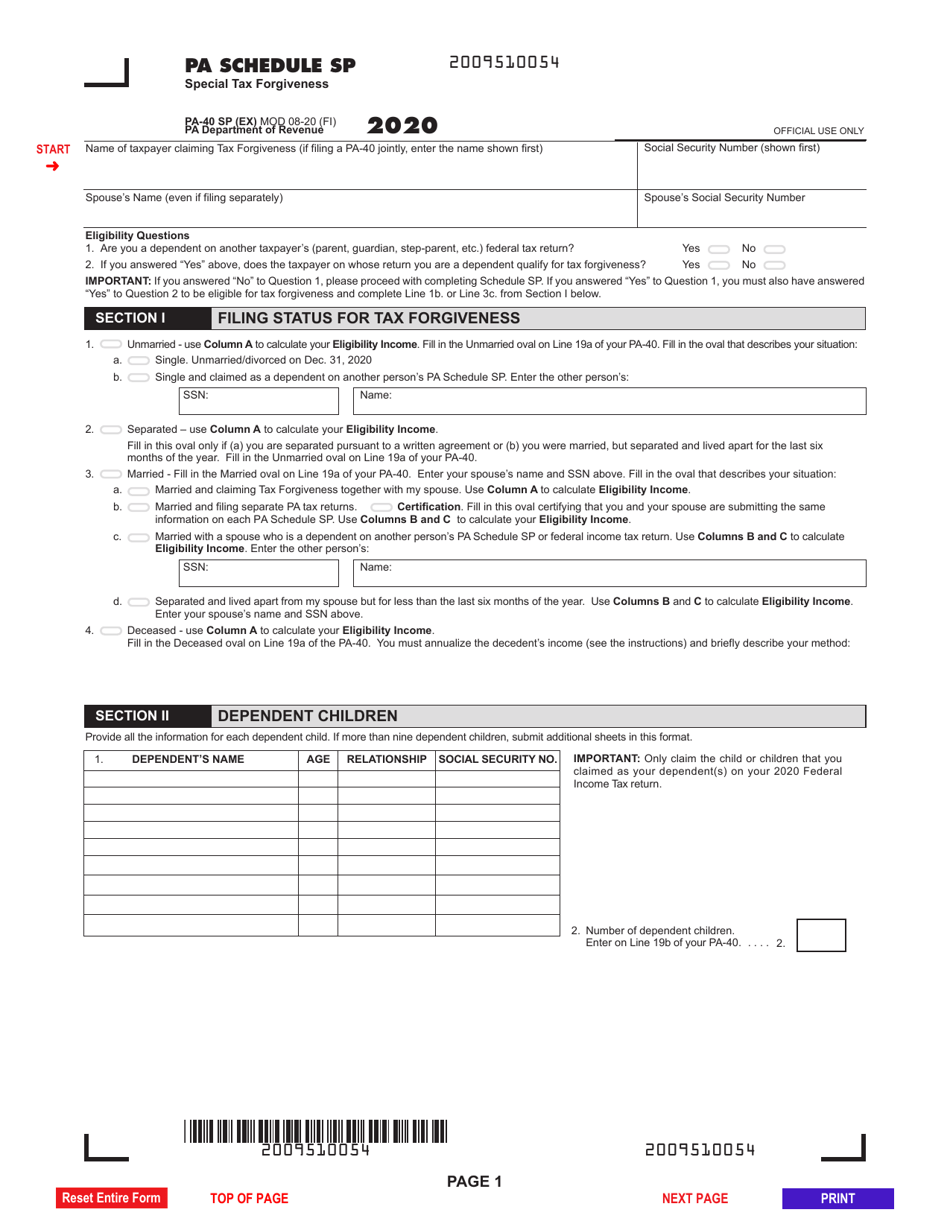

tax forgiveness credit pa schedule sp

Schedule sp part c line 6 must be completed manually for a nonresident. Enter the Nonresident income.

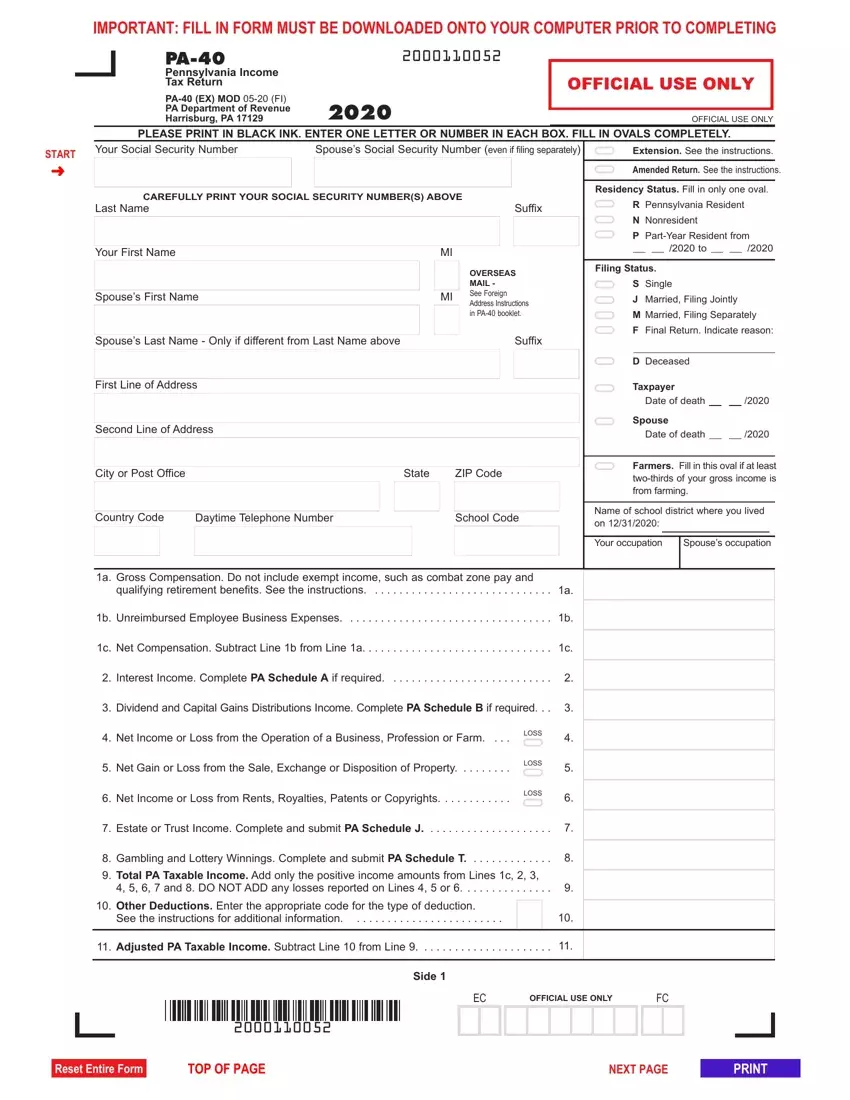

Pa 40 Tax Form Fill Out Printable Pdf Forms Online

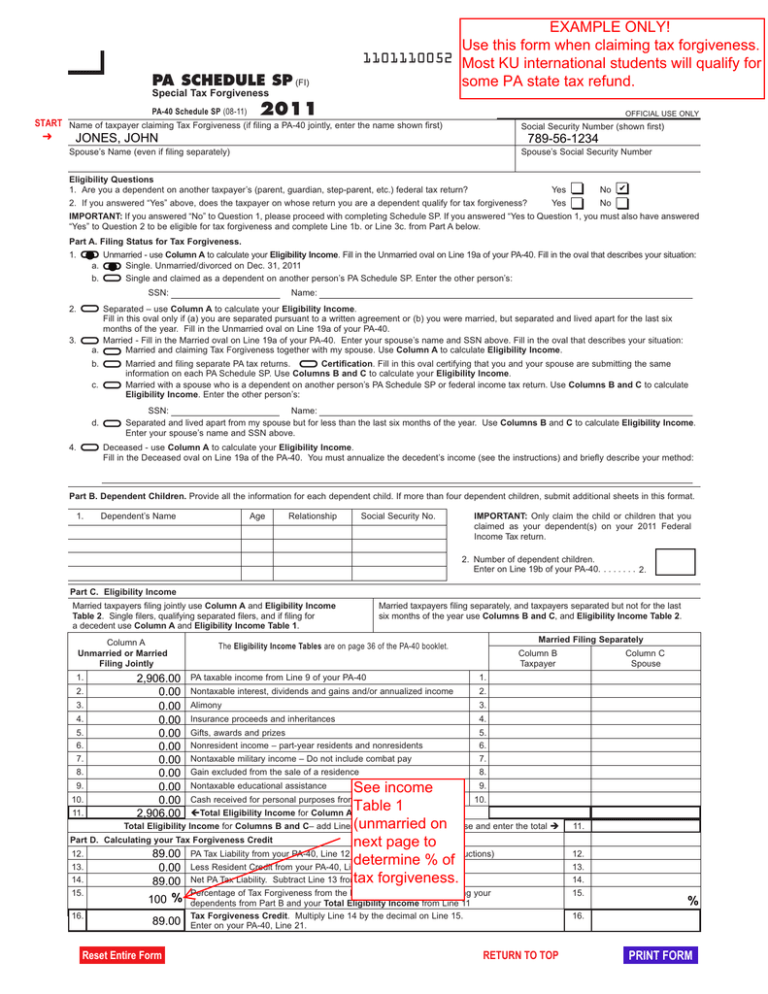

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their pennsylvania personal income tax liability.

. Gives a state tax refund to some taxpayers. Input line 1 - Input Code for Schedule SP. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

If none leave blank. PA Schedule SP - Special Tax Forgiveness. Go to Screen 53 Other Credits.

Doing so on a federal tax return. On PA-40 Schedule SP the claimant or claimants must. If youre approved for tax forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Earnings Tax refund.

Type filer for tax forgiveness. We will update this page with a new version of the form for 2023 as soon as it is made available by the Pennsylvania government. Click on Pennsylvania from the top left navigation panel.

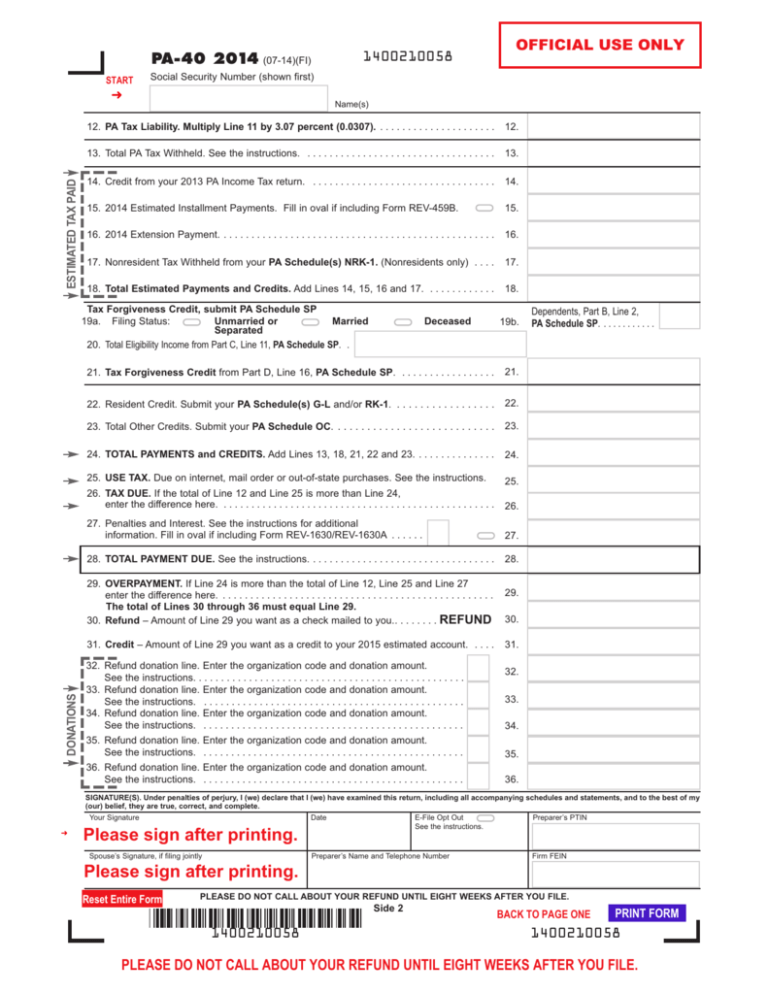

Different from and greater than taxable income. Record the your PA tax liability from Line 12 of your PA-40. What is Tax Forgiveness.

State Tax Forms. Schedule SP Tax Forgiveness Credit. We last updated Pennsylvania Form PA-40 SP in January 2022 from the Pennsylvania Department of Revenue.

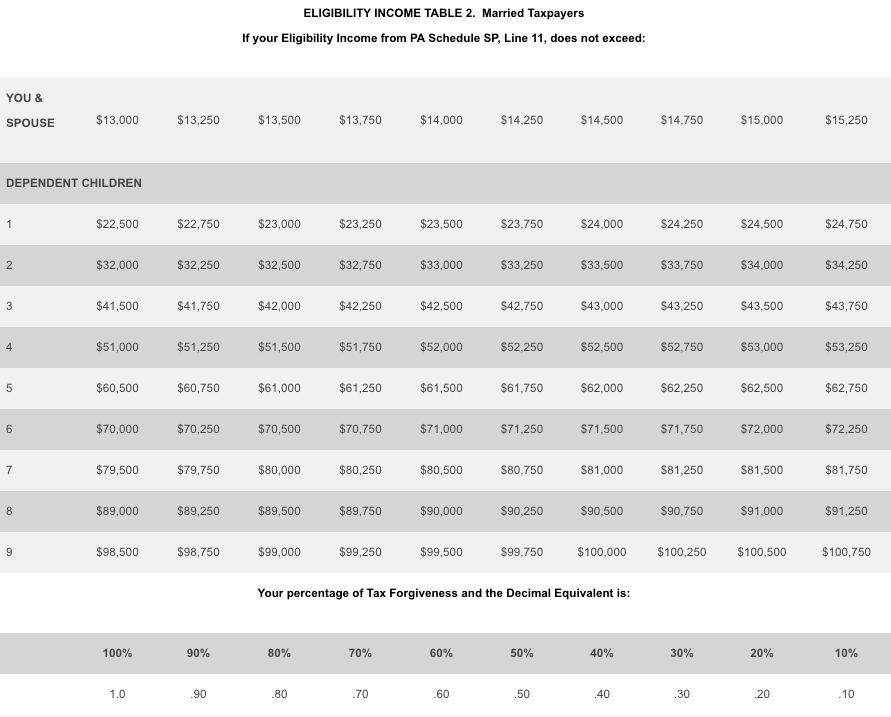

The level of tax forgiveness decreases by 10 percent for every 250 increase in income. You must each submit a copyof the PA Schedule SP with your PA tax return. To see if you qualify check the PA-40 instruction.

It is not an automatic exemption or deduction. To suppress PA Schedule SP. Provides a reduction in tax liability and.

For the Schedule SP you will include all of your taxable Pennsylvania income along with the following nontaxable income. Where do I enter this in the program. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

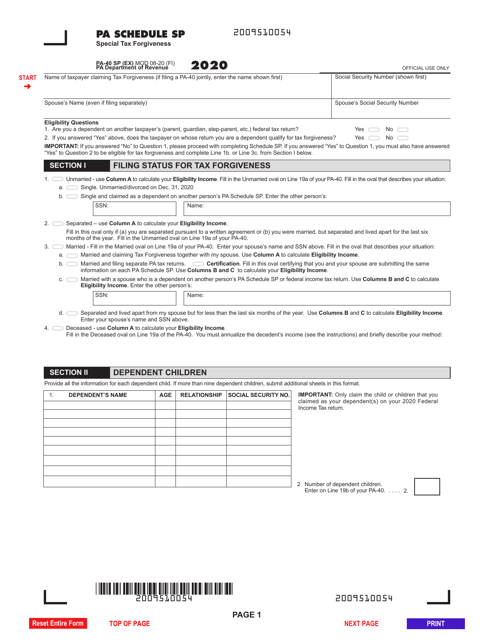

You must fill in the Married and Filing Separate ovalin Part A of each PA Schedule SP. To complete pa schedule sp part c line 6. To claim this credit it is necessary that a taxpayer file a PA-40 return and complete Schedule SP.

Determine the amount of Pennsylvania-taxable income. Pa schedule sp special tax forgiveness credit part a. A single or unmarried claimant determines only his or her own amount of taxable income.

Schedule spd easily create electronic signatures for signing a pa schedule sp in PDF format. Subtract Line 13 from 12. Go to screen 53 other credits.

View all 175 Pennsylvania Income Tax Forms. Lacerte will automatically complete part c line 1. Form PA-40 SP requires you to list multiple forms of income such as wages interest or alimony.

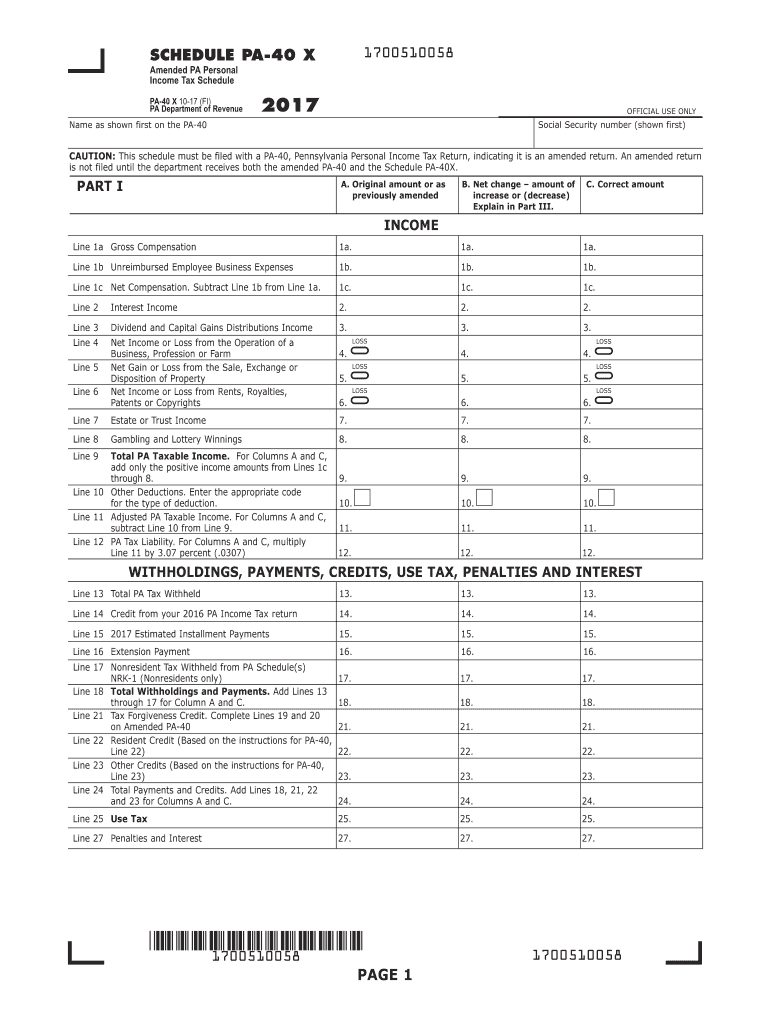

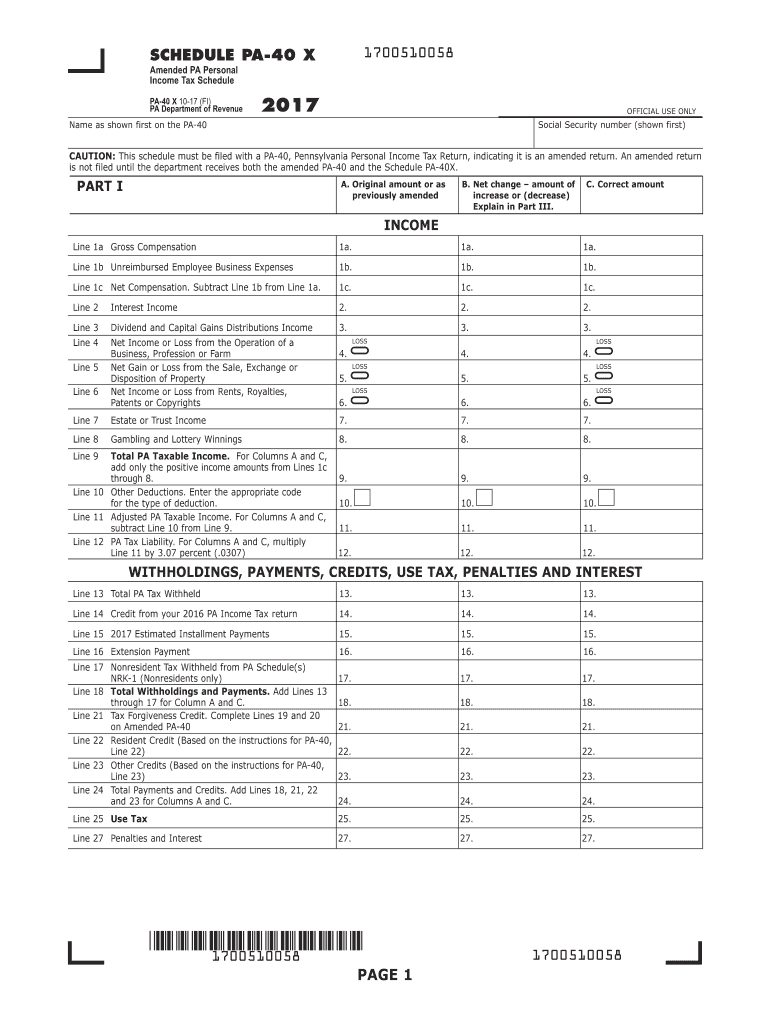

Click section 2 - Tax Forgiveness Credit Schedule SP. To enter this credit within the program please follow the steps below. Section III on Page 2 of Schedule PA-40 X must be completed to explain any increase or decrease to the amount of interest income reported on an amended PA.

Schedule SP Part C Line 6 must be completed manually for a nonresident. Locate the Schedule SP section. Record tax paid to other states or countries.

Schedule sp part c line 6 must be completed manually for a nonresident. From the Eligibility Income Table. It is not an automatic exemption or deduction.

You can go to the ForceSuppress the credit field at the bottom of the PA SP screen and from the drop list select F. Type filer for tax forgiveness. Calculating your tax forgiveness credit 12.

Complete Tax Forgiveness Eligibility income starts with taxable income The eligibility income limit for 100 percent tax forgiveness is 6500 for the claimant 13000 for. SignNow has paid close attention to iOS users and developed an application just for them. Married taxpayers must use joint income for determining eligibility for tax forgiveness even if they file married filing separately.

If Line 13 is. In the Eligibility Income section enter data as needed. This should take you to Screen 53051.

On PA-40 Schedule SP the claimant or claimants must. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income Pennsylvanians that they may be eligible for a refund or reduction of their Pennsylvania personal income taxes through the commonwealths Tax Forgiveness program. This form is for income earned in tax year 2021 with tax returns due in April 2022.

Nontaxable interest dividends and gains andor annualized income-Include nontaxable interest or dividends on items such as bonds any money you received as a beneficiary of an estate etc. Because eligibility income is different from taxable income taxpayers must fill out a PA Schedule SP. Further to qualify for the credit it is necessary to calculate both the taxable and nontaxable income.

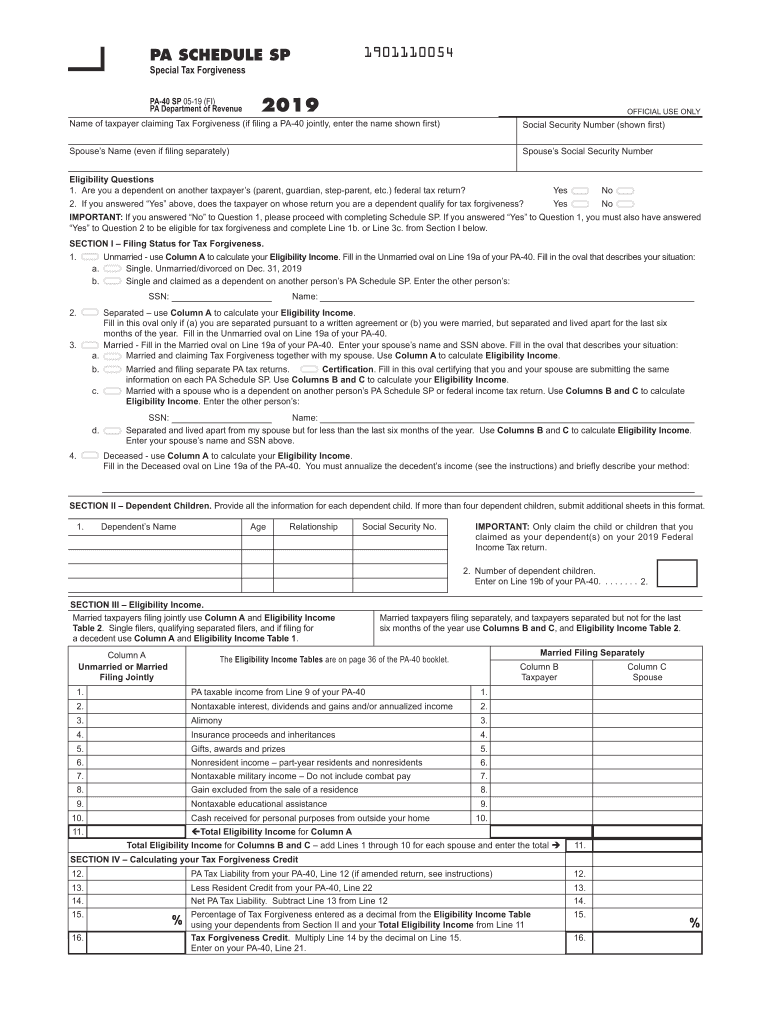

A dependent child with taxable income in excess of 33 must file a pa tax return. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. Download or print the 2021 Pennsylvania Form REV-631 Tax Forgiveness for PA Personal Income Tax Brochure for FREE from the Pennsylvania Department of Revenue.

0001110022 0001110022 0001110022 0001110022 importantchild that you claim as only claim a your dependent on your federal income tax return. Use PA-40 Schedule SP to claim the Tax. To sign a pa schedule sp form right from your iPhone or iPad just follow these brief guidelines.

Then move across the line to find your eligibility income. To claim tax forgiveness the claimant or claimants must complete and submit PA-40 Schedule SP with the PA-40 Individual Income Tax return. In Part D calculate the amount of your Tax Forgiveness.

Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal income tax return. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. If your Eligibility Income from PA Schedule SP Line 11 does not exceed.

If youqualify for Tax Forgiveness you must each complete PASchedule SP as if filing jointly. To find it go to the AppStore and type signNow in the search field. I think my client qualifies for the PA special tax forgiveness credit but Schedule SP is not being produced.

For more information please see. You may NOT claim a dependent child on PA Schedule SP if. The child must file a tax return and a pa schedule sp.

You each must report the sameinformation including dependents and your joint eligibilityincome. Calculating your Tax Forgiveness Credit 12. In the If Dependent of Another Person section enter data as needed.

To complete PA Schedule SP Part C Line 6. In the Tax Forgiveness Credit Schedule SP section enter data into the rest of the fields as needed.

Form Pa 40sp Pa Schedule Sp Special Tax Forgiveness Pa 40 Sp

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

2011 Pa Schedule Sp 1101110052

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa Dor Pa 40 Sp 2019 2022 Fill Out Tax Template Online Us Legal Forms

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Free Form Pa 40 Pennsylvania Income Tax Return Free Legal Forms Laws Com

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pennsylvania Special Tax Forgiveness Credit Do You Qualify Supermoney

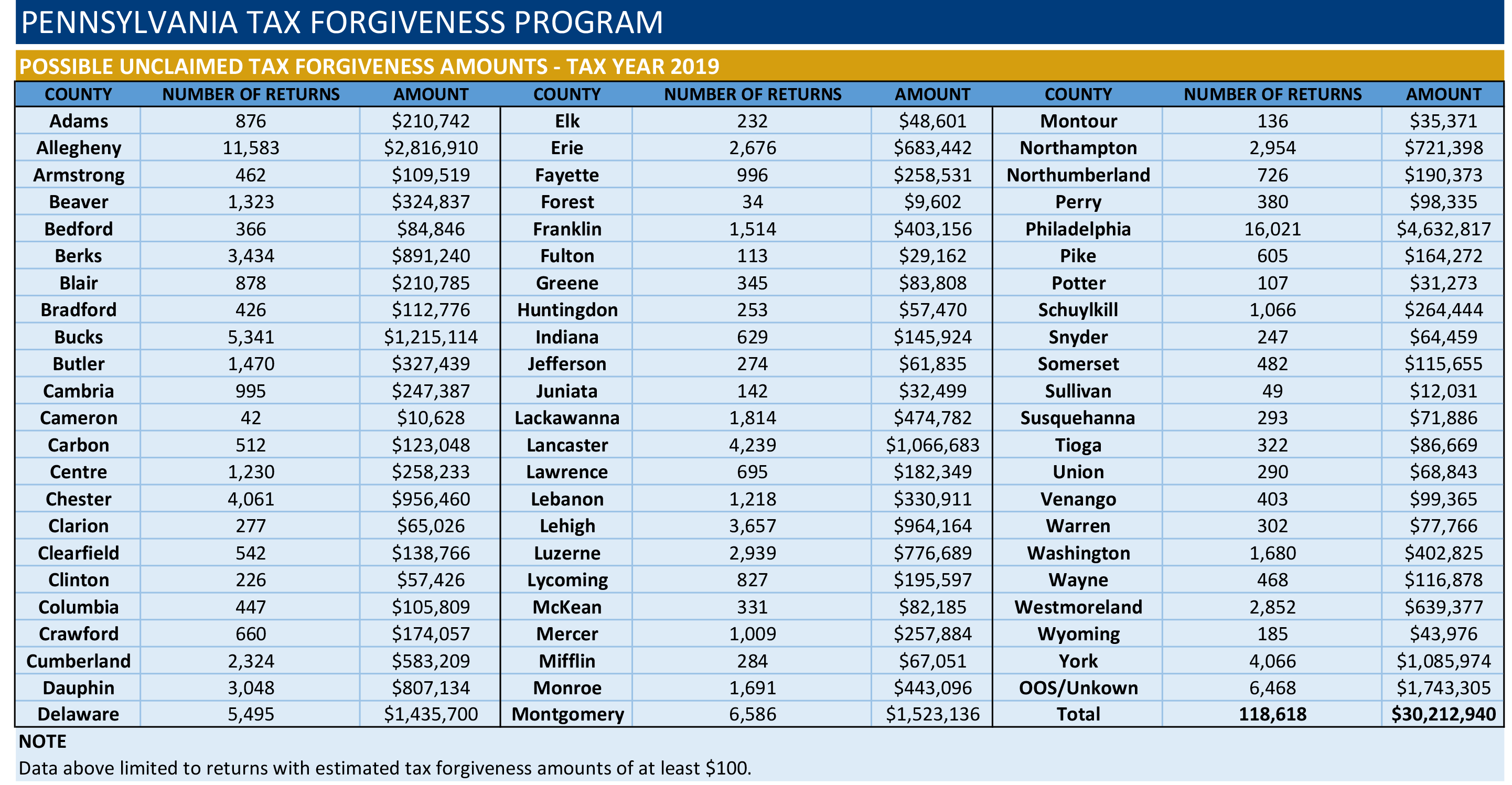

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

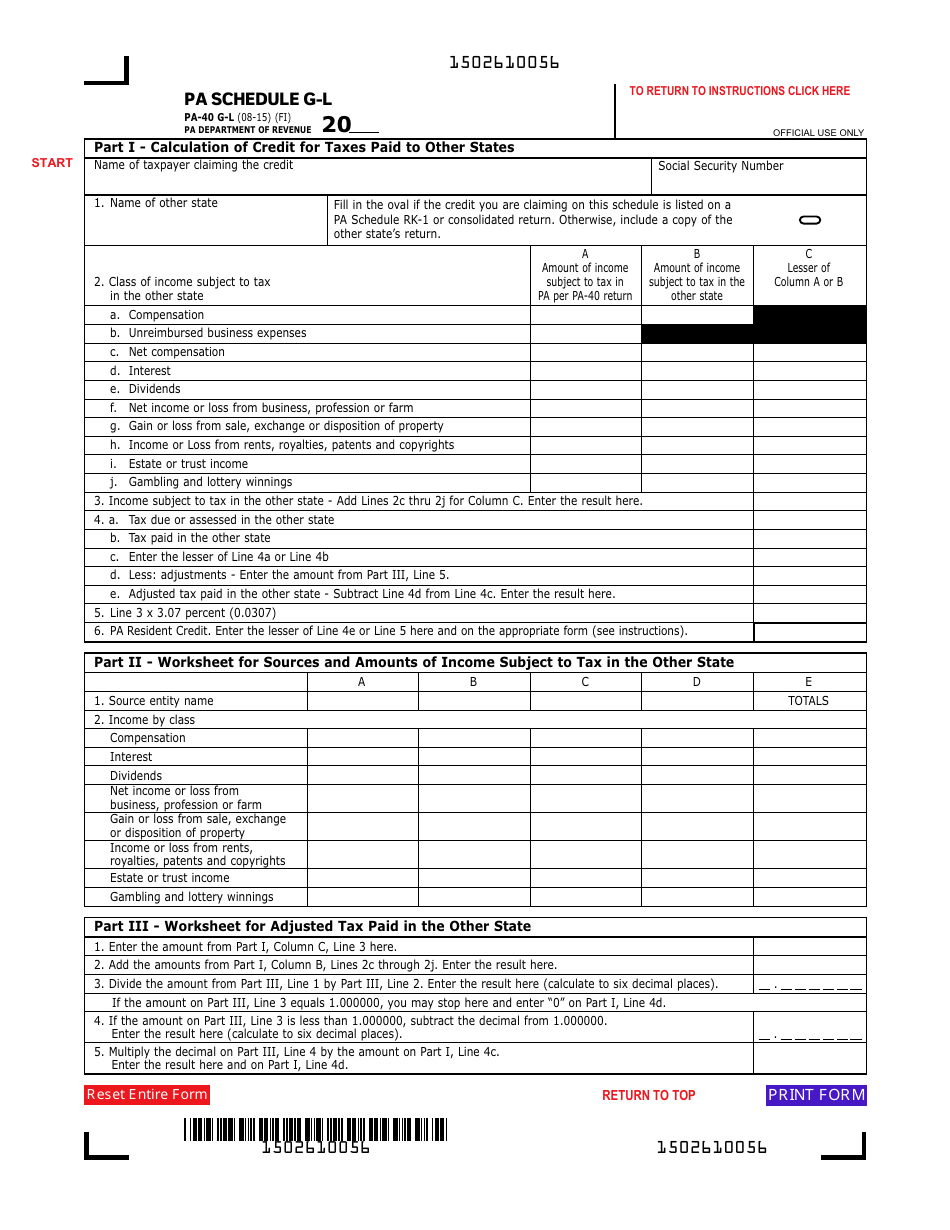

Form Pa 40 Schedule G L Download Fillable Pdf Or Fill Online Resident Credit For Taxes Paid Pennsylvania Templateroller

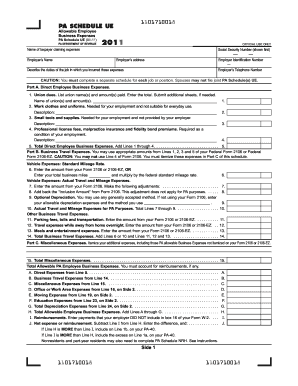

Pa Schedule Ue 2021 Fill Online Printable Fillable Blank Pdffiller

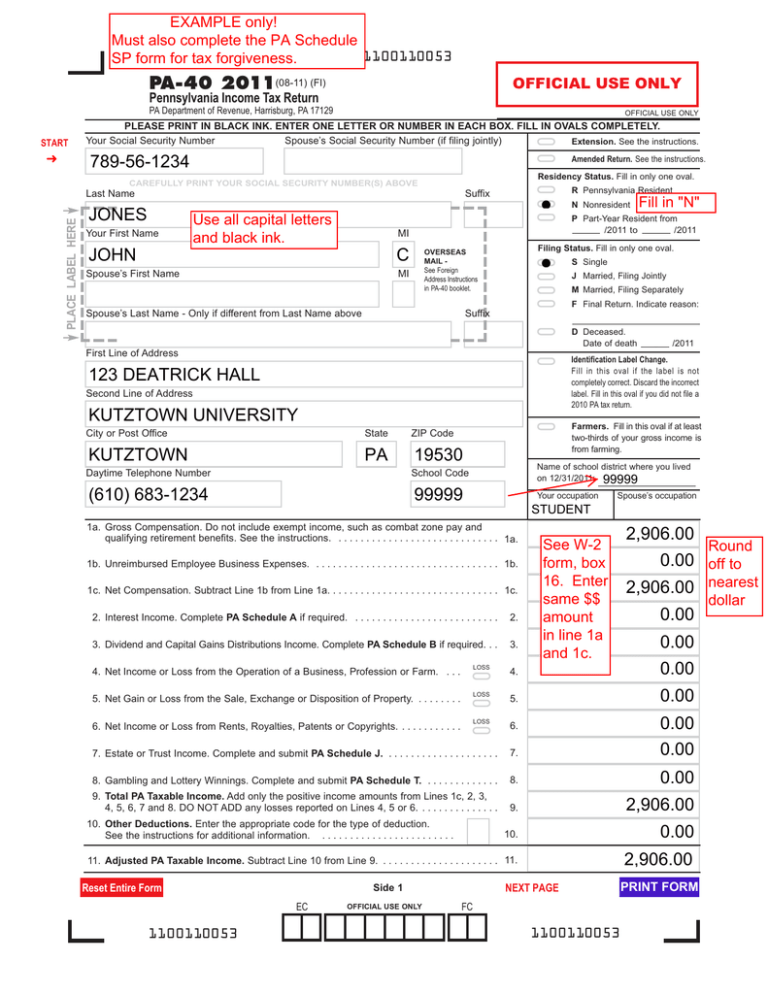

Form Pa 40 2011 Pennsylvania Income Tax Return Pa 40

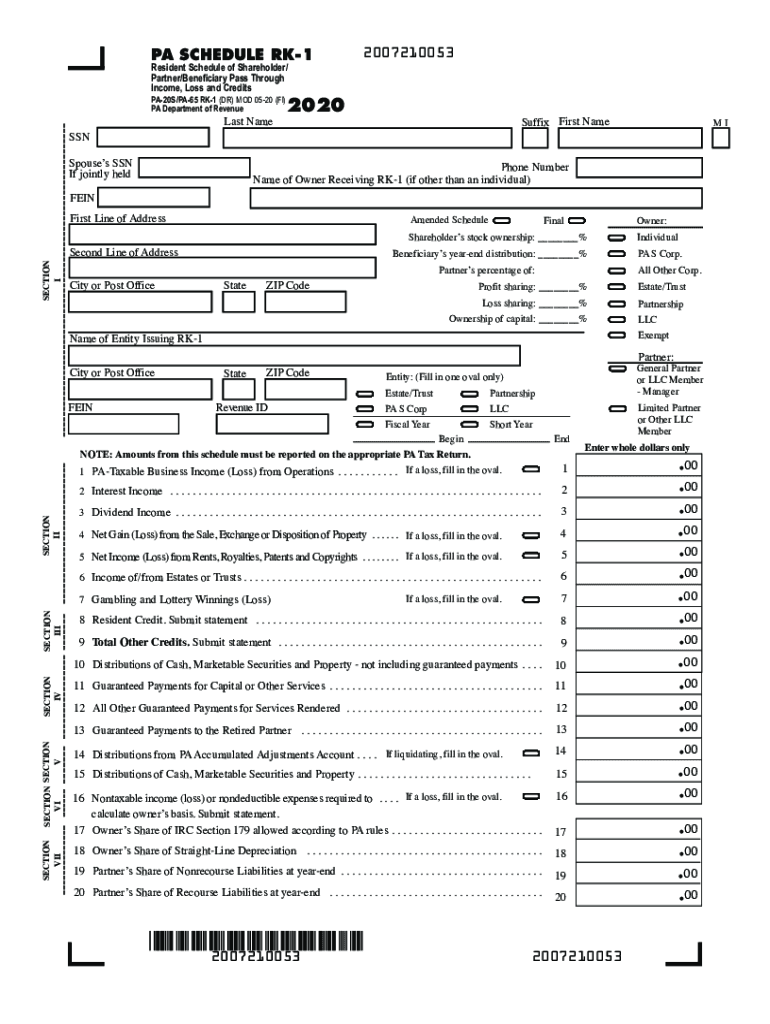

Pa Schedule Rk 1 2020 2022 Fill Out Tax Template Online

Form Pa 40 Fillable 2013 Pennsylvania Income Tax Return Pa 40

Pa Schedule Pa 40x 2017 Fill Out Tax Template Online Us Legal Forms